Source of Income Legislation Passes Michigan Senate – But Bill’s Effectiveness Is Highly Limited By Exemption

The Michigan Senate Exempts Landlords Holding 4 of Fewer Rental Units - Making Fewer Rental Properties Available to Voucher Holders

The Michigan Senate, by a narrow 20-18 vote, passed Senate Bills 205, 206, and 207 to bring long awaited source of income protection to Michigan.*

Senate Bill 207 will amend the Michigan Elliot-Larsen Civil Rights Act to include source of income protection. The bill broadly defines source of income to include “benefits or subsidy programs 21 including housing assistance, housing choice vouchers provided 22 under 42 USC 1437f, public assistance, veterans' benefits, Social 23 Security, supplemental security income or other retirement 24 programs, and other programs administered by any federal, state, 25 local, or nonprofit entity.” As the Senate Fiscal Agency’s Bill Analysis points out, “[t]he Housing Choice Program is a Federal Program meant to assist very low-income families, elderly, and disabled individuals in affording housing.”

Unfortunately, Senate Bill 207 exempts landlords who own fewer than 5 rental units. For several reasons, this exemption will nullify the effectiveness of source of income protections, thus failing to serve the needs of low-income families, our elderly population, and persons with disabilities.

The problem with the less than 5 rental properties exemption is shown by the data contained in a recent report by Detroit Future City, entitled “Understanding the Rental Landscape: A Profile Analysis of the Detroit Landlords to Inform Lead-Safe Housing Policy (August 2022)(“Detroit Rental Landscape”).

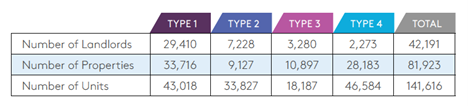

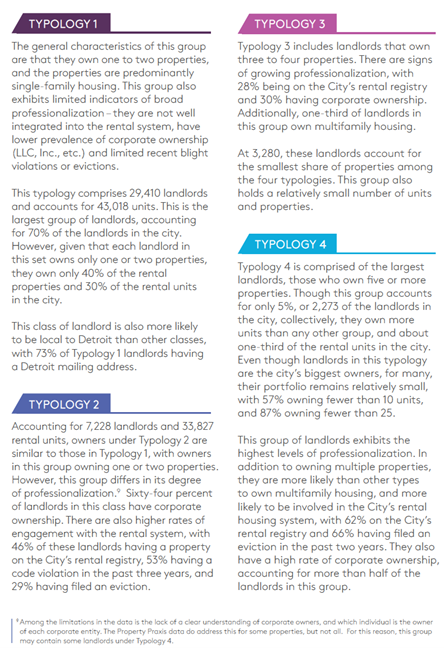

Page 17 of the Detroit Rental Landscape report estimates the total rental properties and units, along with an estimates of landlords owning 1-2 rental units, 3-4 rental units, and 5 or more rental units. The Detroit Rental Landscape data for Detroit* shows the following:

- 141,616 total rental units

- 95,032 rental units held by landlords with 1-4 rental units. This represents 67.11% (95,032 / 141,616) of the Detroit rental market.

- 46,584 rental units held by landlords with 5 or more rental units. This represents 32.89% (46,584) of the Detroit rental market.

Approximately 2/3rds of Detroit rental units will be exempt from source of income coverage. There is no reason to believe that the percentages would be significantly different in other Michigan communities. As such, the 5 or more rental unit requirement means that the majority of rental units in Michigan will be exempt from source of income protections.

Sadly, as to Detroit, source of income coverage will probably not even be available for the 32.89% of the rental units involve landlords with 5 or rental units.** This will likely be the result in other Michigan communities. For a variety of reasons (typically, for investment and tax purposes), property owners often hold title to rental housing in limited liability companies (LLCs), partnerships, or other corporate entities. Rental property owners could easily evade source of income coverage by setting up additional corporate entities and deeding the title to rental properties into those entities.

The 5 or more rental units exemption will increase litigation and investigation time and expense by the Michigan Departments of Civil Rights (MDCR) to resolve threshold concerning the ownership of properties to determine source of income coverage. To illustrate the necessity of detailed investigation and litigation, the bill requires the MDCR or private litigants to examine whether "person", defined as "an individual, partnership, corporation, association, limited liability company, or any other legal entity", is a "related entity", defined as "a person that, directly or indirectly, controls, is controlled by, or is under common control with another person."

Further, the remaining units owned by landlords who chose to retain title to 5 or more rental units may still be unavailable if the rental rates for the units exceed the Fair Market Rent rate established by HUD.

Finally, to examine the number of rental units exemption in its historical context, Congress included the no more than 3 single family home exemption into the Fair Housing Act (42 U.S.C. § 3603(b)(1)) upon its enactment in April 1968. The congressional record (and text of the FHA, 42 U.S.C. § 3601) is replete with Congress’ concern as to the constitutionality of the FHA. Congress believed restricting the number of homes subject to the FHA would increase the likelihood of the FHC being found constitutional. The Supreme Court’s decision in Jones v. Alfred H. Mayer Co., 392 U.S. 409 (1968)—holding that 42 U.S.C. § 1982 reached purely private housing transactions—was not issued until June 1968. Section 1982 has none of the exemptions found in the FHA. Id. at 415 (“§ 1982 contains none of the exemptions that Congress included in the Civil Rights Act of 1968 [FHA]”). Had Jones been issued earlier, there would have been no Congressional concerns as to the FHA’s constitutionality and, therefore, likely no such 3 single family exemption.

Unfortunately, the unnecessary pre-Jones exemptions continue. HUD aided the continuation of these exceptions, acquiescing in the inclusion of the pre-Jones FHA exemptions in state statutes and local agencies seeking substantial equivalency status (24 C.F.R. § 115.204(a)(4)) well after the Jones decision. So now 55 years later we must deal with an outdated exemption approach that will severely undercut the beneficial effects of source of income protections. Our marginalized, low-income Section 8 recipients—many of whom are elderly and persons with disabilities—deserve better.

Let’s hope the Michigan House of Representatives, upon consideration of Senate's bills, will fully consider actual effects of the exemption on the number and percentages of rental units in Michigan communities available to voucher holders and remove this exemption its entirety.

*Currently, at least 14 cities in Michigan provide source of income protections: Ann Arbor; East Lansing; Ferndale; Grand Rapids (not enforced as to vouchers); Holland; Jackson; Kalamazoo; Kentwood; Lansing; Oak Park; Royal Oak; Royal Oak Township, Saginaw, and Wyoming. Additionally, Detroit provides similar, if not broader, coverage for “public benefit status”.

**As noted above, Detroit prohibits discrimination based on “public benefit status” under Article IV, Section 27-4-1 (Selling or leasing real estate—Unlawful practices). Few Detroit residents and applicants for Detroit housing, however, are aware that "public benefit status" affords the same protections as source of income provides.

Contact Information

Address: 5555 Conner St., Suite 2244 Detroit, MI 48213-3487

Phone: (313) 579-FAIR

Fax: (313) 963-4817

Email: info@fairhousingdetroit.org

Business Hours

- Mon - Thu

- -

- Friday

- -

- Sat - Sun

- Closed

Our Location

Contact Information

Address: 5555 Conner St., Suite 2244, Detroit, MI 48213-3487

Phone: 313-579-FAIR

Fax: 313-963-4817

Email: info@fairhousingdetroit.org

Business Hours

- Mon - Thu

- -

- Friday

- -

- Sat - Sun

- Closed

Our Location

Contact Information

Address: 5555 Conner, Suite 2244, Detroit, MI 48213-3487

Phone: 313-579-FAIR

Fax: 313-963-4817

Email: info@fairhousingdetroit.org

Business Hours

- Mon - Thu

- -

- Friday

- -

- Sat - Sun

- Closed